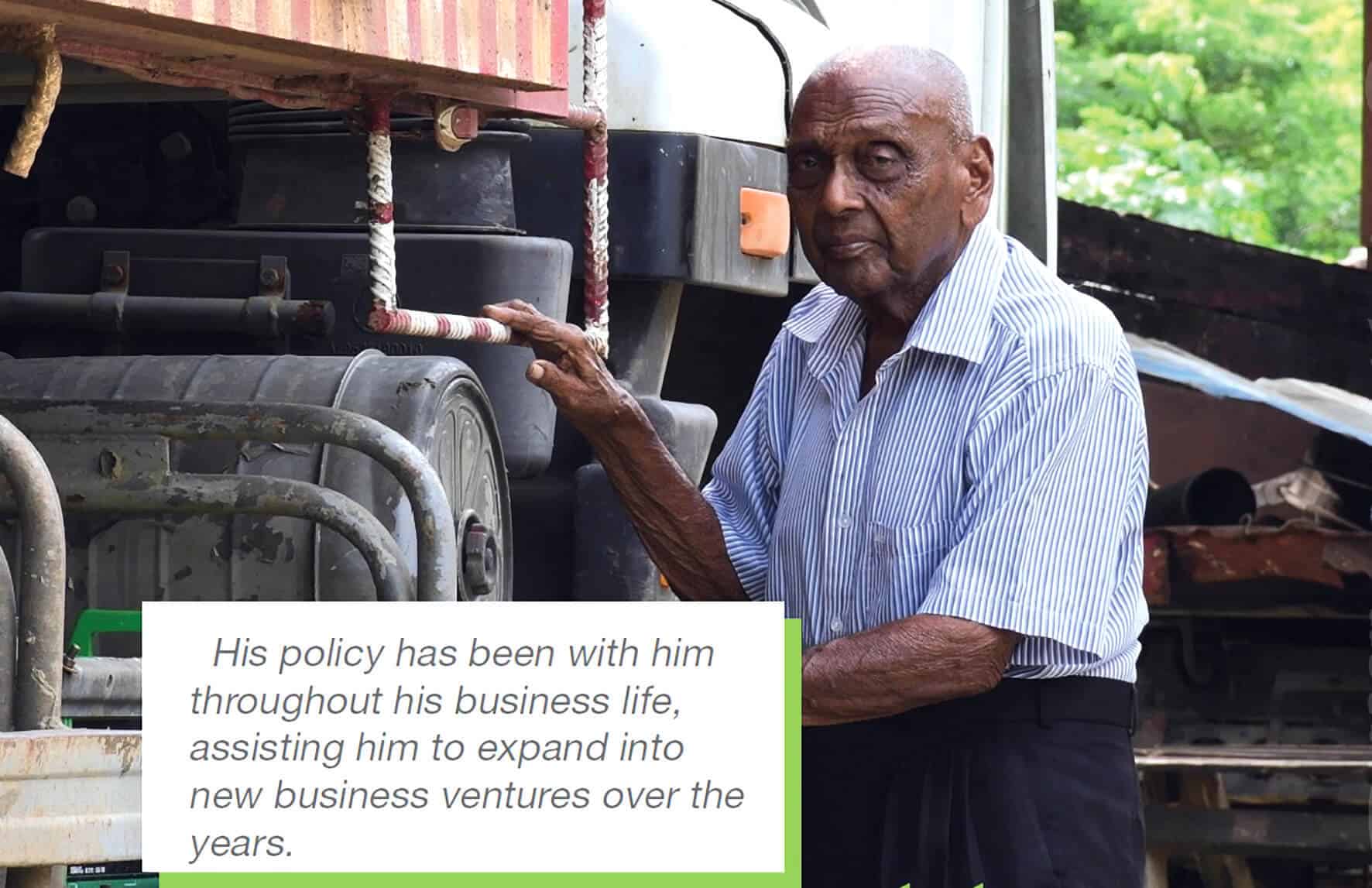

Shiu Prasad is BSP Life’s oldest customer. Born in 1928, he purchased his first policy in 1968 as owner of T. Makanji shop in Sigatoka. Over the years, his policies have enabled him to expand into new business ventures.

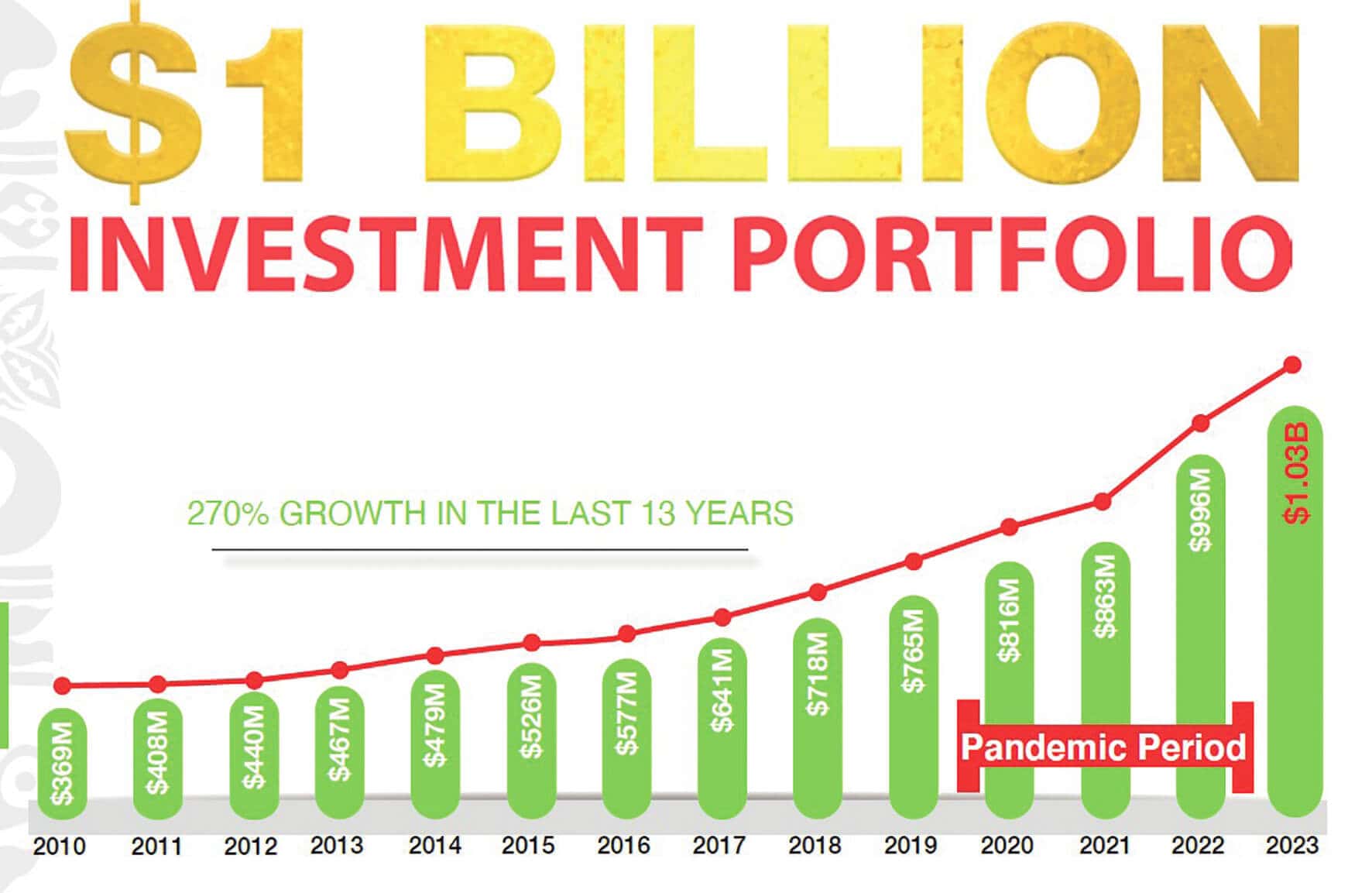

Mr Prasad now enjoys the fruits of his policy as BSP Life’s most loyal and longstanding customer. BSP Life officially announced that its Investment Portfolio has passed the $1 Billion milestone at an event attended by Prime Minister Sitiveni Rabuka on August 29.

Customers like Mr Prasad benefit from this high performing Investment Portfolio, and a share in the $80 million in customer benefits, and $36.8 million customer bonus—the highest in BSP Life’s history—announced earlier this year.

Marking the $1 Billion milestone, BSP Life Managing Director, Michael Nacola stated: “Today holds a distinct significance not only for BSP Life but also for all our subsidiaries, stakeholders including the people of Fiji and our valued customers. BSP Life’s story is unique, entwined with Fiji’s history and development for over 145 years. I am delighted to share this significant news of BSP Life’s remarkable accomplishment of our investment portfolio surpassing the one-billion-dollar milestone. This achievement firmly positions us as a leading institutional investor in Fiji.”

Remarking earlier on the bonus payments, Nacola said: “The bonuses are distributed to our life insurance customers with investment-linked policies. It is a celebration of their trust in us, and we are excited to reward them for their loyalty following the challenging COVID-19 pandemic period.”

While it was the largest bonus payout in BSP Life’s 145 years of service, it is just the latest in a decade of growth. Over the last 10 years, BSP Life has allocated over $200 million in bonuses.

“Our ability to consistently allocate high bonuses is underpinned by our diversified investment portfolio which grew despite the pandemic. We had the largest year-on-year growth of $89 million in 2022, taking the portfolio to $985 million. This maintains BSP Life’s position as the second largest institutional fund in Fiji,” Nacola said.

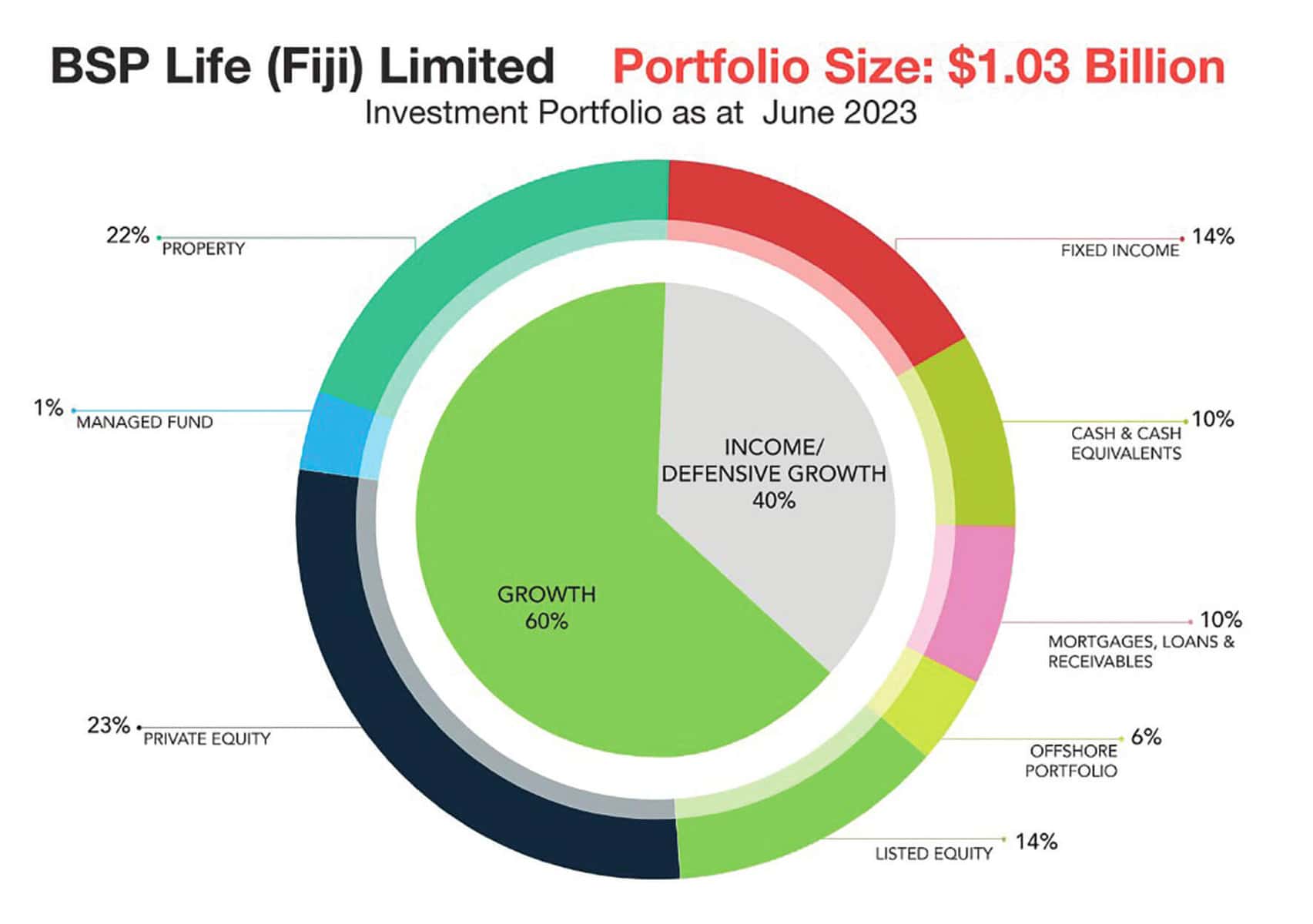

That investment portfolio, which includes some of Fiji’s most iconic brands, has since crossed the $1 billion mark, and every customer with an investment-linked policy—in entrusting their contributions to BSP Life—can see their investment at work almost everywhere they look

Through these investments, BSP Life employs hundreds of Fijians, supporting the livelihoods of theirs and their families.

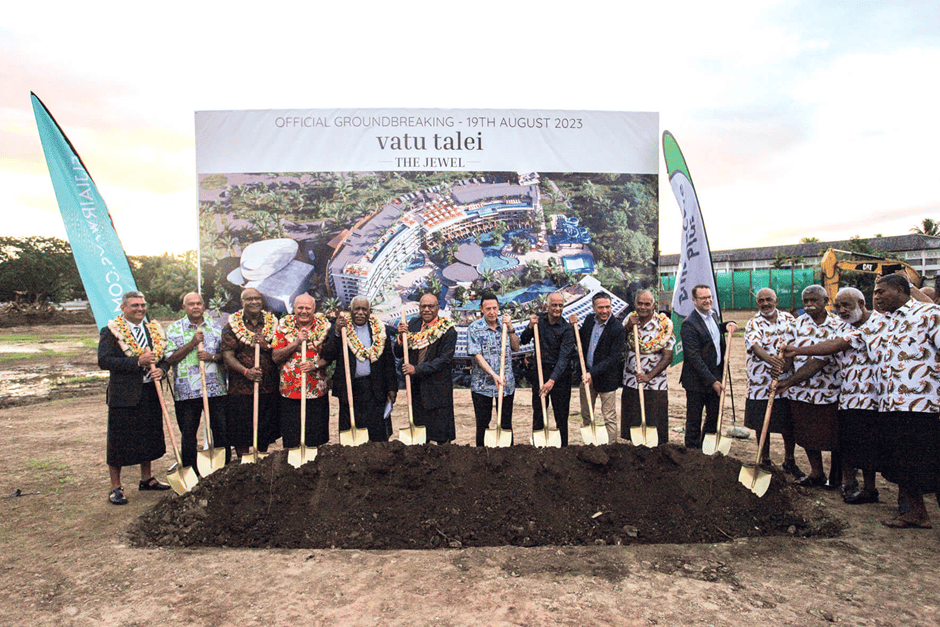

BSP Life’s portfolio includes tourism properties such as the Sofitel Fiji Resort and Spa on Denarau Island, Vatu Talei (The Jewel Project) which is a new luxury resort area set to open in 2026, medical services such as Oceania Hospitals, manufacturing, food processing, financial services, retail, supermarket chains, and government bonds and investments.

Its property holdings include iconic commercial properties, luxurious residential complexes and vital industrial warehouses, creating landmarks that stand as a testament to the company’s dedication to excellence.

BSP Life’s stake in Rooster Chicken—now inextricably linked to Fiji’s all-conquering Fijiana Drua rugby team and the mighty Fijian Drua—has seen the business grow from a family-owned business in Ba to an international quality accredited operation assisting Fiji’s self-sufficiency in poultry and one of the largest employers in the Western Division.

“These investments have been carefully crafted to ensure the portfolio consistently generates high returns, particularly for our policyholders. It also supports thousands of jobs and builds communities. So, the breadth of BSP Life’s investments is intricately interwoven in the fabric of Fijian society.”

The diversified nature of the investment portfolio means that it has delivered value even through the uncertainty of COVID-19.

“In 2022, we paid a historic $80 million in customer benefits and announced our highest-ever bonus allocation of $36 million. By June 2023, we have surpassed $40 million in customer benefits and anticipate exceeding 2022’s figures. We continue to invest in our business, technology, and our people, ensuring we can respond to changing customer needs and market conditions.”

Ultimately, while policies with BSP Life deliver stakeholders financial security and a tangible stake in the economic growth and health of their nation, they also provide peace of mind at the most difficult times.

Tina Jackson was young, had a loving husband and two healthy children and fulfilling work as an aircraft engineer, when she was diagnosed with Hodgkin Lymphoma. It seemed her world suddenly stopped turning.

“It was terrifying. When I first learned I had cancer, my husband was with me, yet I felt deeply lonely. My first thoughts were about my children; my babies were 4 and 6 then. What would happen to them?”

But as a BSP Life customer, she was instantly covered.

“You don’t have to worry about accommodation, travelling, medical expenses, or medical bills; BSP Health covers all of these. I’m so fortunate we had coverage with BSP Health through my company,” Jackson said.

“If it wasn’t for BSP Life Insurance, I definitely would not be here today.”

BSP Life paid $44 million in Customer Benefits for January – June 2023. This equates to around $1.7 million a week, an increase of 13% from the average of $1.5 million a week in 2022.

Most payments were for survival benefits and maturities from life insurance policies at $30 million. Death and Disability payments totalled $6 million while Health insurance payments totalled $8 million.

“We are delighted to see an increasing trend in benefit payments which is tied to customers commitment to their policies, particularly investment linked insurance policies that are long-term in nature. It takes commitment and financial discipline to keep policies active, and we take great pride in seeing customers benefit from the wise financial choices they make,” said Nacola.

“Of the total $44 million in payouts so far this year, 68% were for living benefits meaning customers receive lump-sum cash to support their life goals ranging from children’s education, to starting a business, purchasing an asset, retirement, or taking a family holiday.”

BSP Life, which is proudly ‘100% local’, also has deep links and respect for the communities in which it has flourished and continues to operate. That is why its customers see it represented, as a sponsor and participant, in a broad range of community activities, from environmental initiatives to plant mangroves and trees, at school sports festivals, as platinum sponsor of Leadership Fiji and through last year’s ‘50 million step challenge’ to raise funds for WOWs Kids Foundation.

As for the future, BSP Life is confident it will build on last year’s successes throughout 2023.

“The outlook is positive with further growth anticipated, allowing us to sustain value for customers. Our life insurance products provide an excellent investment platform with returns realised in the short- to medium-term, complementing long-term retirement savings with the Fiji National Provident Fund. We particularly encourage our young job-entrants to invest with us and be part of a fast-growing investment portfolio.”

BSP Life’s oldest customer, Shiu Prasad has already ensured that his whole family is reaping the benefits of holding policies with BSP Life.

His son, Aman reflects: “Looking at my dad’s investments in life insurance policies and how he used these to assist him grow his businesses over the years, compelled me to also take out life insurance policies. Today, my whole family has policies, my dad, wife, and my daughters – we all have policies. Seeing the Bonus allocations, like $32 million shared last year, makes us feel really good that our investments are growing. We have made wise decisions to invest in life insurance with BSP Life.”