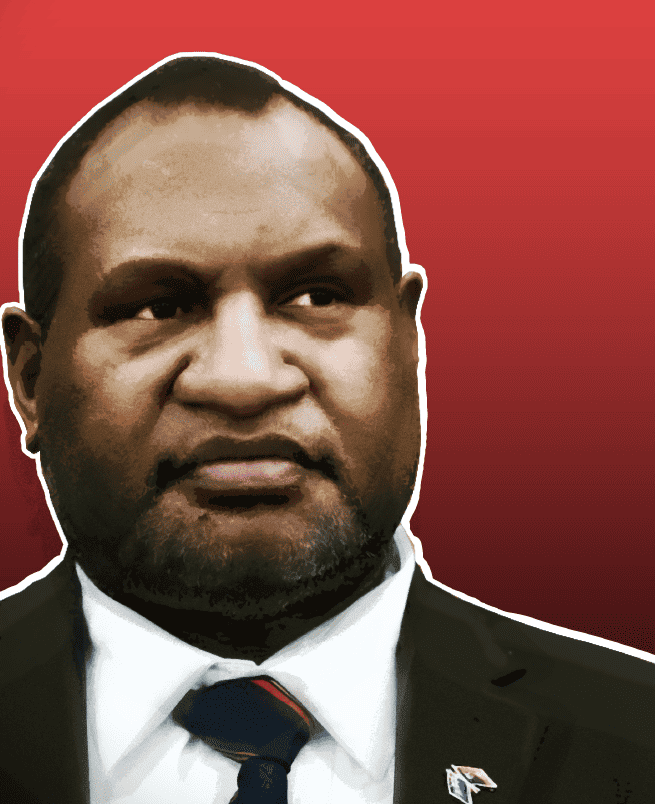

The government of Papua New Guinea’s newly re-elected Prime Minister, James Marape will be focused on building investor confidence and getting Porgera reopened, as it begins its new term.

In his first speech to parliament after re-election, Prime Minister James Marape said he wanted PNG to become a K200 billion (US$56.8 billion) economy in the next 10 years.

The International Monetary Fund predicts economic growth of 4.2% this year, and 4.7% in 2023, largely powered by growth in the resources sector. The IMF expects GDP growth to subside . . .

Please Subscribe to view full content...