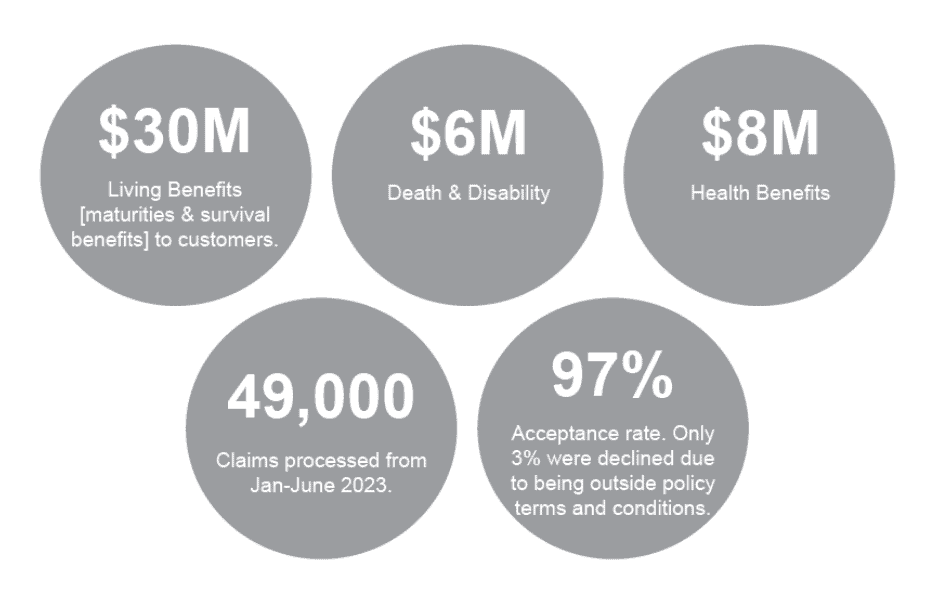

BSP Life today announced it paid $44million in Customer Benefits for January – June 2023. This equates to around $1.7 million a week, an increase of 13% from the average of $1.5 million a week in 2022.

Most payments were for survival benefits and maturities from life insurance policies at $30 million. Death and Disability payments totalled $6 million while Health insurance payments totalled $8 million.

BSP Life’s Managing Director Mr Michael Nacola said, “We are delighted to see an increasing trend in benefit payments which is tied to customers commitment to their policies, particularly investment linked insurance policies that are long term in nature. It takes commitment and financial discipline to keep policies active, and we take great pride in seeing customers benefit from the wise financial choices they make. Of the total $44million in payouts so far this year, 68% were for living benefits meaning customers receive lump-sum cash to support their life goals ranging from children’s education, to starting a business, purchasing an asset, retirement, or taking a family holiday.”

Mr Nacola added, “We aspire to provide world-class service to customers, exemplified by the high volumes of benefits processed within short turnaround times, at an acceptance rate that is comparable with international standards”.

BSP Life has 10 Customer Service Centres around Fiji, a customer portal on its website www.bsplife.com.fj and a 24/7 Emergency Helpline.

About BSP Life

BSP Life is Fiji’s leading Life and Health insurance company with over 145 years’ experience. Formerly owned by the Commonwealth Bank of Australia and operating as Colonial Life & Health, the Company was acquired by BSP in November 2009 and rebranded BSP Life in 2011.

Products and services include:

- Personal life insurance plans to cover education, retirement, mortgage protection, savings and investment, in addition to financial protection for loved ones in the event of untimely passing of the life insured. Policies are designed to suit the personal circumstances of the individual or family and take into account premium affordability.

- Key-man policies to enable business continuity in the event of untimely passing of a key person, including Directors.

- Group Medical and Term Life products. BSP Life currently provides local hospitalization, overseas evacuation and outpatient coverage for most of Fiji’s large corporate companies.

- Family and Individual Medical policies are also available.

- Loan protection insurance inclusive of a funeral benefit on the untimely passing of the borrower, for those taking out unsecured personal loans with BSP Bank and vehicle loans with BSP Finance.

As one of Fiji’s largest institutional investors, BSP Life’s investment portfolio is now valued at over F$996.6 million (Mar 2023). The portfolio includes a number of landmark commercial properties in the Suva CBD, a gated high-end residential property, majority shareholding in Richmond Pte Limited trading as Sofitel Fiji Resort and Spa and 100% ownership of Oceania Hospitals Pte Limited and Future Farms Pte Limited trading as Rooster Poultry. The Investment portfolio is balanced and diversified to ensure returns are optimized for customers who have a direct interest in the portfolio as Policyholders.

BSP Life (Fiji) is the first insurance company for the BSP Group with 10 Sales and Customer Service Centers and 150 Insurance Advisors licensed by the Reserve Bank of Fiji. BSP Life has the largest insurance customer base in Fiji with more than 90,000 customers and over 100,000 policies.

About the BSP Group

The BSP Group is a leading provider of financial services including retail and business banking, life insurance and health insurance. BSP has a proud and established reputation in Papua New Guinea, and a long history of highly successful business in the region. BSP has become the most respected bank in Papua New Guinea. Aside from Papua New Guinea, BSP is represented in Fiji, Samoa, Tonga, Cook Islands and Solomon Islands.