Cyclone Yasa bought a wet and windy full stop to a very difficult year for Fiji’s people.

South Pacific Business Development Fiji General Manager, Elrico Munoz, says their Vanua Levu, Rabi and Taveuni clients were particularly affected.

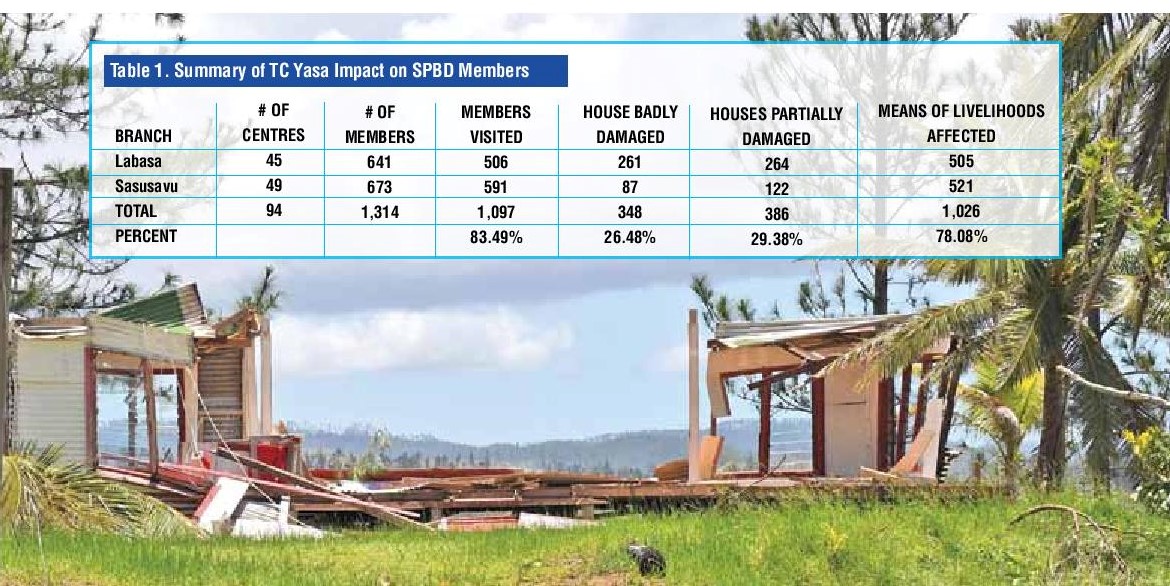

“We were able to visit about 83.49% of our clients in the Northern Division (where we have two branches) as part of our rapid assessment exercise, Munoz said. “As shown in the table below, more than 50% of the 1,314 SPBD members in the Northern Division report varying degrees of damage to their houses and around 78.08% of them suffered losses from their means of livelihood.”

“We asked our clients what assistance do they need from SPBD. Relief operations were already done by the Fijian government, NGOs and other multi-lateral donor agencies. Hence, SPBD’s focus was more on rehabilitation of houses and sources of livelihood. Some clients just wanted a grace period for their loans.”

SPBD also provided:

• A grace period of six weeks for loan repayments.

• A rehabilitation loan for members to fix their homes and revive their sources of livelihood.

“SPBD is a social enterprise – as such we address both financial and social bottom lines. SPBD addresses crises arising from disasters and pandemics head on, so we can bring about meaningful change in the lives of the clients.”

TC Ana, which affected parts of Fiji in January did not damage the homes of SPBD to the same extent as Yasa, but it did bring heavy rains and floods, which stopped some clients from getting around and destroyed some farms and other SPBD member businesses. As a result, SPBD is looking at relief to members affected by Ana, although rehabilitation loans for home reconstruction won’t be necessary.

SPBD has had to adopt nimble strategies during these uncertain times says Munoz. “Making SPBD always relevant to the lives of its clients will ensure deepening of our relationship with them. We are also looking forward to develop certain financial products with potential partners such as weather index insurance, that will build client resilience in the face of these challenges.”

SPBD Director, Lorraine Seeto, will formally launch the TC Yasa Rehabilitation Loan Programme in February, with the first batch of beneficiaries receiving their payments on the same day. Their stories will also be featured in the Kiva website (www.kiva.org.lend?country=fj) for crowd-funding.