Twenty Fijian women recently benefitted from an engaging three-day training program organised by Business Assistance Fiji (BAF), in collaboration with South Pacific Business Development (SPBD) and the Centre for Excellence in Financial Inclusion (CEFI).

“BAF builds a network of service providers in the areas of accounting, financial management, loan facilitation, e-commerce, digital transformation, marketing standards, and human resource management,” says BAF General Manager, Ramesh Chand.

Through this network, BAF provides training that diagnoses Micro, Small and Medium Enterprises (MSMEs) and identifies areas of improvement where service providers can assist.

The recent training at SPBD’s headquarters in Suva covered three topics: Digital Financial Literacy, E-commerce, and Business Planning & Debt Management.

“Digital financial literacy is a very important topic. The participants were taught the pros and cons of using digital platforms,” said Chand. The training also covered cybersecurity risks.

Digital products and services available to MSMEs were also discussed, including internet and mobile banking, EFTPOS, and digital wallets such as PayPal.

“The participants learnt about the benefits of various online (e-commerce) platforms such as Amazon, Alibaba and eBay, where they can sell their business products and save on business costs,” Chand added.

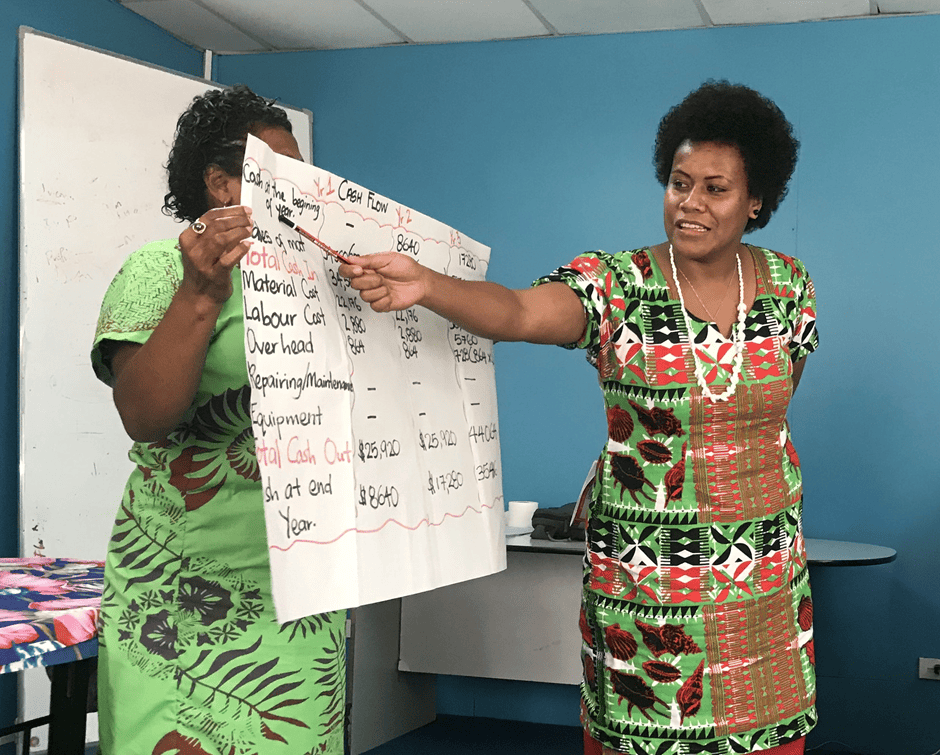

As for Debt Management, Chand says a lot of MSMEs in Fiji took business loans during COVID-19 and are facing difficulties in repaying them. “Our debt management training can assist them in organising themselves in a way that they are able to meet their debt obligations and also plan for future loans that they wish to take,” he noted. Cash flow management was one of the main skills taught to participants to combat debt.

BAF plans to run similar training in all divisions.

SPBD Director, Lorraine Seeto says the training will give SPBD members a better insight of the journey in joining the formal MSME sector.

“With the training, SPBD will continue their support in helping members register their businesses. FRCS officials have provided training on tax identification numbers, income tax returns and tax compliance certificates, and is willing to come onsite at SPBD’s headquarters and other branches to assist SPBD members with regulatory issues,” she said.

“It is through such collaboration and cooperation together with assistance provided by the authorities that SPBD members will be adhering to the requirements of the regulatory agencies,” she added.

The Importance of Knowing Your Business, and Your Worth

What does it take to be a successful business owner? It starts with identifying the nature of the business, says Aslam Khan, Business Advisory Manager – Central Division of the Fiji Ministry of Trade, Co-operatives, SMEs and Communications (MTCSMEC).

After a hiatus of two years, SPBD has resumed its Financial Education Facilitator (FEF) training – in partnership with MTCSMEC and the Fiji Revenue & Customs Service (FRCS) – with two sessions in April and May. A total of 43 Financial Education Facilitators, each representing 43 different SPBD centres based in the greater Suva-Nausori area participated in the ‘Improve your business’ training.

SPBD’s Financial Education Facilitators are trained to assist their centre members with preparing weekly Cash Flows and Business Plans. They are also responsible for checking their members’ Financial Diaries and empowering them with business tips at weekly meetings. The FEFs are also responsible for collating the information required for business registration from their members. This will expedite the process as the information will feed immediately to the SPBD Fiji Bloom Assistant, Vika Vinakadina, who will assist in registering SPBD’s members’ businesses.

“A business owner should know the type of business they are running. So, if someone asks, ‘What type of business do you do?’ one would say, ‘I own a manufacturing business or I make food and sell it,’” said Khan.

Khan says the women entrepreneurs were reminded of the importance of bookkeeping. “It is very essential because it will help them to assess their cash flow. It would also give them an indication on how they can reduce their expenses. For any small business, they need to reduce their expenses and maximise profit,” he said.

Knowing their product cost was an eye-opener for some of the participants as well, he says. “When they know their product cost, then they can set a price. And once they do that, then they can make profit,” Khan emphasised.

Emele Sorowale of SPBD Nauluvatu Centre, agrees, saying: “We would find it hard to price our items. But through this training, we are now equipped to do it accurately, taking into account the cost of materials and the overhead cost,” she said.

Sorowale joined SPBD in 2016 and runs a successful handicraft business selling sasa brooms, woven mats and tabua (whale’s tooth) which she delivers to customers every Friday. “My business is going well, yet from what I learnt today, I am convinced to save more and spend less of my earnings,” she said.

Reapi Tabuaniviti of SPBD Raralevu Centre 2, reiterated: “From what I learnt at this workshop, I will encourage my centre members that joining SPBD is not just about paying off your loans. We need to know our costs and save more,” she said.

Tabuaniviti operates a small kava business. “I sell a bag for around $2-$5 and I make good profit. I don’t give interest or discounts. I only allow people that I know to buy my grog on credit, especially those that have jobs,” she revealed.

The Raralevu Centre 2 entrepreneur says she plans to sell other products as well. “Another project I’m working on is my nursery where I will sell kumquat and baigani,” she said.

FRCS Principal Assessor Shaheen Hussain also highlighted the importance of filing tax returns. “We have identified that some of them have missing returns. Tax compliance forms can only be issued if their returns are updated with us,” she said.

“We understand that most of them are doing small businesses in fish farming, weaving, or running a canteen. So, this kind of knowledge will make them confident and be in a position to negotiate with us and others,” she added.

Hussain encourages women entrepreneurs to seek FRCS’ help when necessary. “FRCS can give them training on basic tax, income tax, and how to make a profit and loss statement,” she said.

SPBD’s General Manager, Elrico Munoz, officiated the closing ceremony and expressed his sincere gratitude to MTCSMEC for organising an excellent training program for SPBD members.

“This training is indeed valuable, as it provides FEFs with the necessary tools and knowledge to help their co-members in improving and formalising their different business ventures.

“The FEFs have a significant responsibility to help their fellow members grow and develop their businesses, and this training has equipped them to do so effectively,” he said.

Munoz said the knowledge and skills that FEFs have acquired through the training will have a multiplier effect as they return to their respective centres and share what they have learned.

“I am confident that the knowledge and skills you have acquired will enable you to create positive change in your communities, and I look forward to seeing the impact of your work in the months and years to come,” he added.

SPBD is expected to organise similar workshops in the Northern and Western Divisions this year.

Meet the Members

A young Taveuni woman has survived the slow economy of the past two years to now run her business on two islands.

Ruth Roselyn Sidal’s success has been made possible, thanks to the help provided by her family and South Pacific Business Development (SPBD).

“Many of our customers come and buy large quantities of walu (Spanish mackerel) and kawakawa (grouper),” Sidal says.

“We sell a variety of fish, lobsters, sea prawns, mud crabs, octopus, and just recently, we added coconut crabs, mussels, sea grapes and sea urchins to our product list.

“We have our own boats and we work with other local fishermen when there’s less seafood supply. We buy it from them and retail it,” she adds.

Her business, Ruth Fish Supplies, is based in Taveuni and she has just opened a new branch in Votualevu, Nadi.

While she has met with success, operating a seafood business comes with risks. “When the weather is bad, I don’t get supplies and I don’t get enough cash flow. But when the weather is good, everything is blooming.

“As a 26-year-old business owner, it took a lot of trust in myself. Right now, I not only support myself but also all the people I employ. I see my business growing every single day. We’ve established another shop and we have bought more freezers and other inventories; we’ve even got a vehicle now. The business is expanding. Even though COVID hit us, we’re still in business and staying strong,” she says.

Sidal joined SPBD in 2018 and through their support, she says she has managed to save $3,200 so far. “I’m currently in my fifth cycle with SPBD and in two months’ time, I’m planning to increase my loan cycle to $15,000,” she said.

She encourages other young women to join the program. “Their service is timely and they give you more time to use the funds,” she added.

Sidal has big ambitions for her business, and hopes to be exporting her seafood products to the international market next year.

In Nabouwalu village, a small canteen has become a go-to spot for its delicious homemade ice treats.

The business is owned by 44-year-old Lavenia Savai, who joined South Pacific Business Development (SPBD) in February this year.

“My usual customers are government workers and the village children who buy my strawberry-flavoured ice blocks and ice cream,” said Savai.

“People love my homemade ice block and ice cream, yet sometimes, when the electricity supply in our village goes off, it affects my sales,” she revealed.

To circumvent this issue, she prepares and sells other products like suki (local Fijian tobacco) and yaqona (kava).

“My business in selling yaqona has been successful. I sell my yaqona for $6 per kg,” she said.

The businesswoman and mother of six children is very grateful for SPBD’s support. “SPBD has enabled me to have starting capital. And, they have also helped me fulfil most of my family and village commitments. I hope to keep improving my business and living standards,” she said.