FIJI has officially launched its first Green Finance Taxonomy, establishing a pioneering framework to drive investment in climate and development priorities as part of a vital shift toward a low-carbon economy.

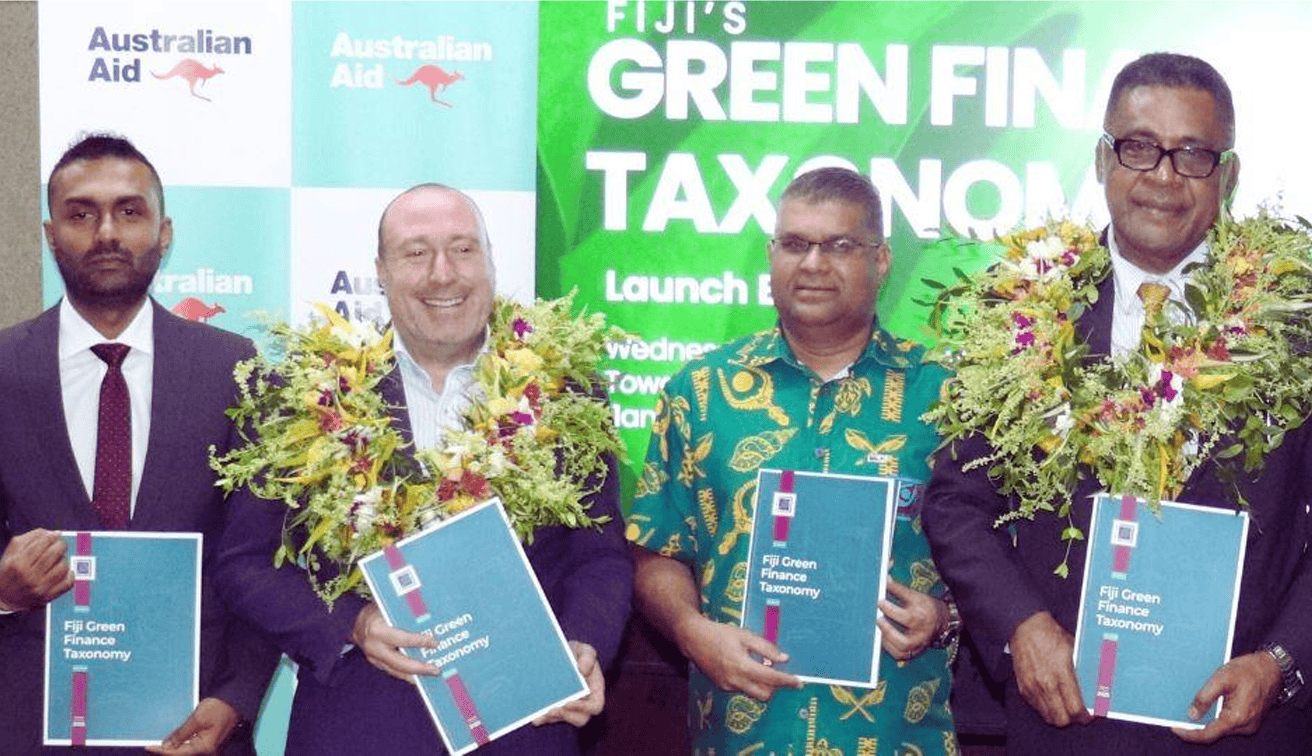

“The Fiji Green Finance Taxonomy provides a clear framework for channelling private capital into climate-aligned investments, advancing our national environmental and development priorities,” said Esrom Immanuel, Minister for Finance, Commerce and Business Development, during the official launch.

“This initiative is a pivotal step toward strengthening financial resilience and ensuring stability in the face of escalating climate challenges.”

The milestone achievement reflects the success of a partnership among the Reserve Bank of Fiji (RBF), the International Finance Corporation (IFC), and the Climate Bonds Initiative to deliver a robust tool to guide green finance and accelerate Fiji’s transition to a low-carbon economy.

“Aligning Fiji with global standards, including Australia’s Sustainable Finance Taxonomy, will unlock more opportunities for projects that protect the environment and support local communities,” said Peter Roberts, Australia’s High Commissioner to Fiji.

“We applaud RBF’s leadership and its collaboration with IFC in laying this foundation, and we look forward to continued engagement to expand inclusive high-impact green finance in Fiji.”

Fiji, a small island state, faces severe climate change impacts like rising seas, stronger cyclones, and changing rainfall.

The government shows global leadership by ratifying the Paris Agreement and adopting strategies such as the updated NDC, Climate Policy 2018–2030, Green Growth Framework, and Low Emission Strategy 2018–2050.

Reaffirming RBF’s commitment, RBF Governor Ariff Ali stated, “This Taxonomy is a cornerstone of Fiji’s sustainable future, empowering the financial sector to channel investments into climate-aligned projects and drive a resilient, low-carbon economy.”

The Fiji Green Finance Taxonomy is a critical tool that:

• Defines and labels green investments – establishing a common language for what qualifies as “green” or “sustainable” in Fiji

• Mobilises private capital – creating a predictable environment for green projects and fostering innovative financial products

• Enhances transparency and integrity – setting clear criteria to improve disclosure and prevent greenwashing

• Supports policy implementation – serving as a reference for incentives, regulations and financial products that promote sustainable economic activity

• Builds national capacity – promoting shared understanding of sustainable finance across sectors and stakeholders; and

• Enables measurement and reporting – integrating with Fiji’s Measurement, Reporting and Verification system to track impacts and strengthen accountability.

Version 1.0 of the Taxonomy prioritises climate change mitigation, with a focus on the energy and transport sectors, which are significant sources of greenhouse gases in Fiji.

Activities are assessed against strict technical and social safeguards to ensure they support climate goals without harming other environmental priorities.

“Central banks play a pivotal role in driving the sustainable finance agenda by setting credible standards that strengthen market confidence,” said Stefano Mocci, World Bank Group Country Manager for Fiji.

“We commend the RBF’s leadership and the strong collaboration with IFC, supported by the Government of Australia, in the development of the Green Finance Taxonomy; a significant milestone that aims to mobilise private capital and align policies with climate and sustainability goals.”

Matteo Bigoni, Climate Bonds Initiative (CBI) Head of Taxonomy, added, “By launching this Taxonomy, Fiji is equipping its financial sector with the clarity needed to shift from ambition to action, directing capital toward projects that deliver tangible climate and development benefits today.”

“CBI is pleased to have contributed technical expertise to this milestone, helping ensure the framework reflects global best practice while remaining firmly anchored in Fiji’s priorities.”

The Green Finance Taxonomy, developed with input from government and private-sector leaders, provides a science-based classification of sustainable activities tailored to Fiji’s context and aligned with international standards.

The RBF will work closely with the project team to raise awareness and build capacity across targeted institutions to ensure effective implementation.