Originally established as a retirement fund, the FNPF has diversified its offerings to include housing, medical, and education assistance for its members, all while remaining steadfast in fulfilling its primary mission. For numerous members, the FNPF serves as a lifeline, providing essential support in times of need. For others, it is a symbol of financial security. Indeed, the FNPF embodies these roles and more.

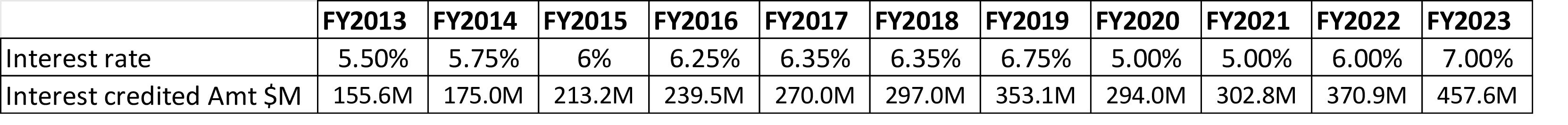

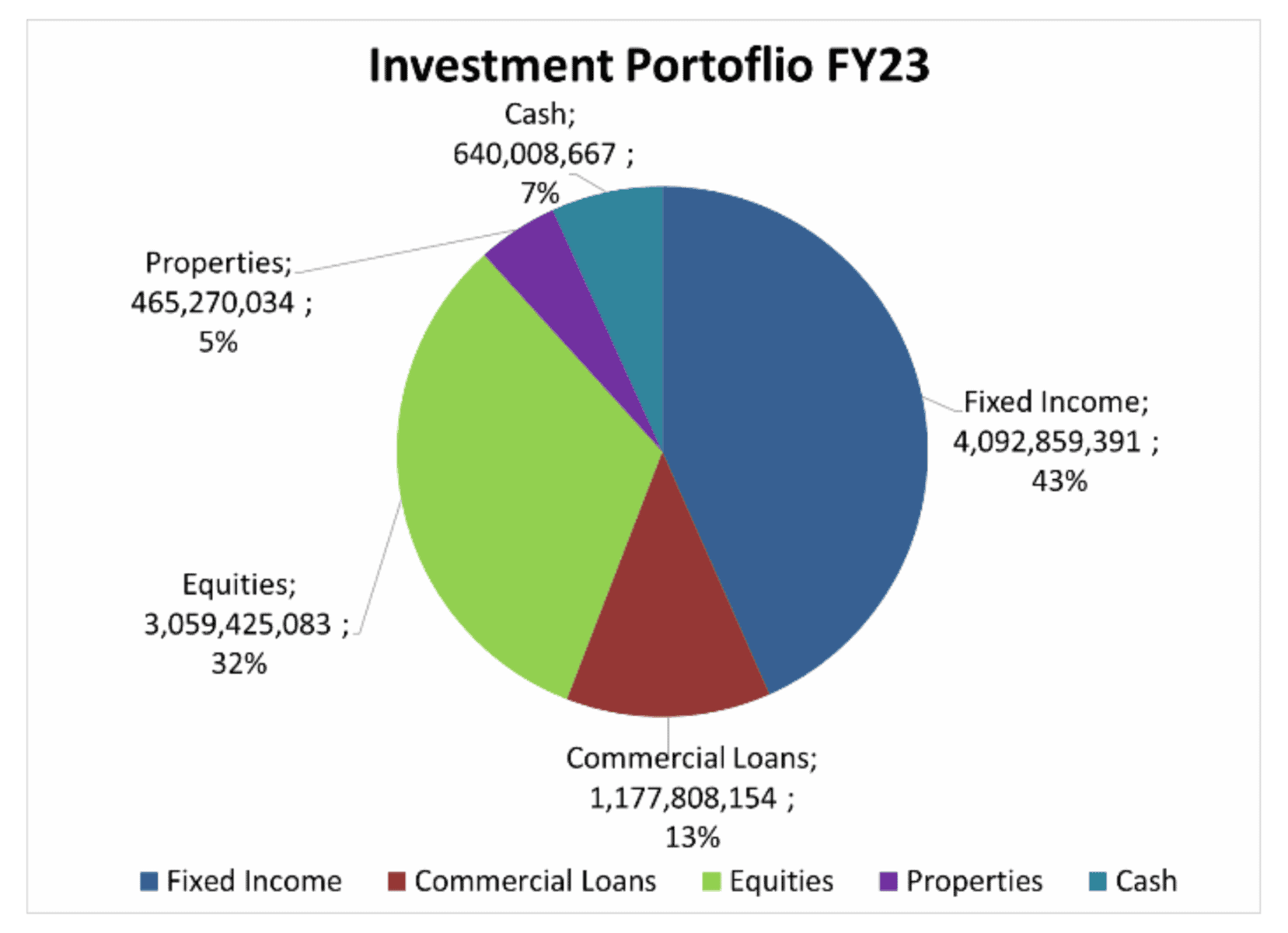

Over the past decade, the FNPF has emerged as a significant force in Fiji’s financial landscape. Beyond its role as a prominent investor, it has solidified its position as one of the nation’s leading property holders. Through strategic initiatives, the FNPF has upheld defensive asset investments while simultaneously broadening its footprint in growth-oriented sectors including telecommunications, banking, tourism, energy and beyond.

Today, the FNPF’s investments are spread out across different sectors and types of assets, set up to make money for its members.

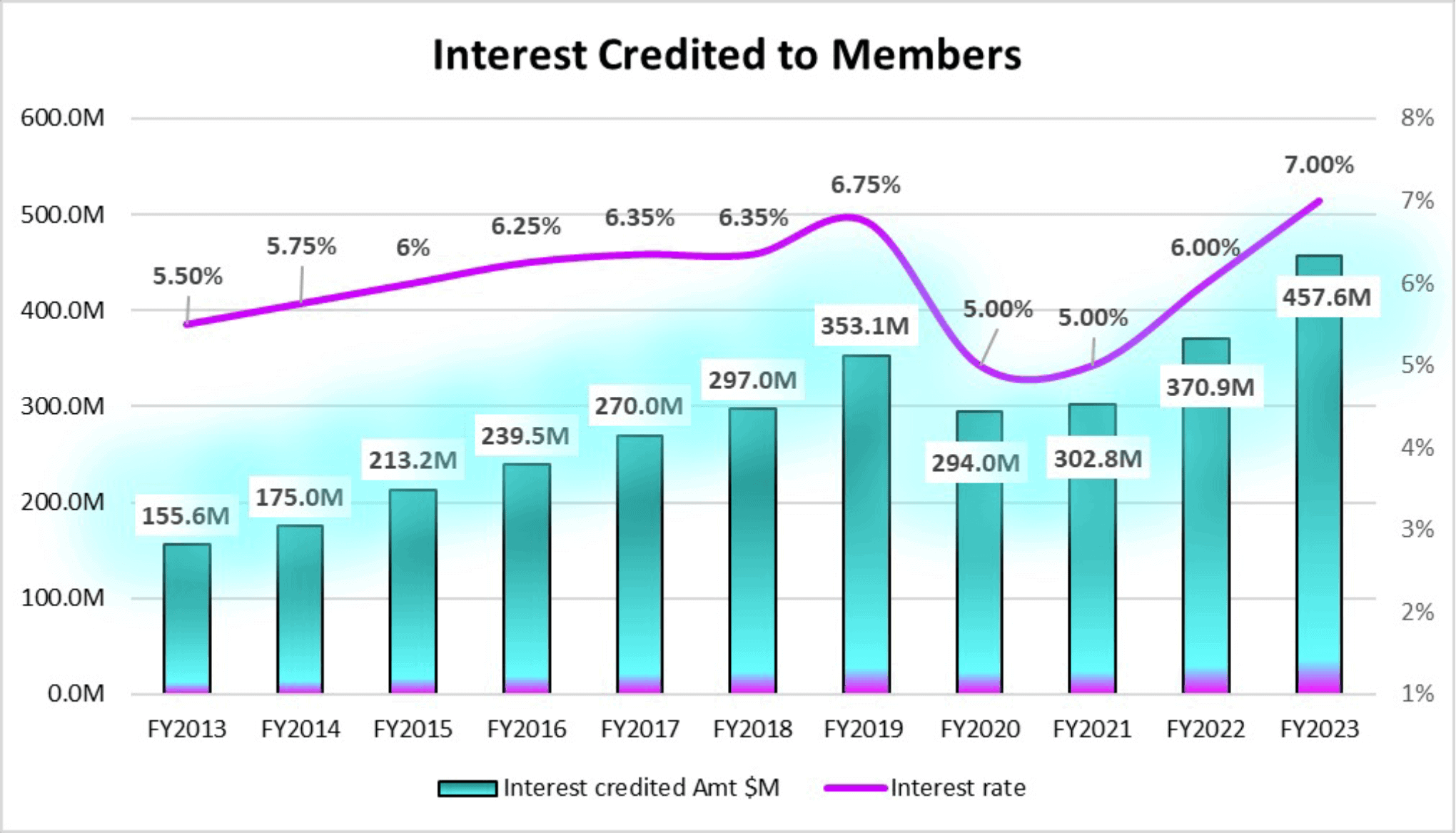

Historical earnings for our members makes a purposeful journey to retirement

We know that Members’ interest lies in sharing profits responsibly and equitably.

Interest allocated to members represents the distribution of profits accrued throughout the year. Interest rates are set after confirmation by the FNPF Actuary that they won’t jeopardize the fund’s solvency requirements. A higher interest rate indicates a robust Fund performance – a track record that keeps the Fund motivated to continue earning income for its members.

All account types, be it compulsory or voluntary, receive equal interest rates. Voluntary members can enhance their contributions annually to benefit from these interest distributions, which are tax-free.

FNPF Investment Portfolio & Returns

The Fund’s Investment Portfolio has shown robust growth over the past 10 years, through a commendable trajectory from $4.1 billion in FY13 to a $9.4 billion in FY23. FY24 projections are looking positive.

This represents a substantial advancement in the Fund’s financial standing and underscores the success of our investment strategies.

The Fund recorded a net increase in Net Assets of $721.7M for the year, which was the basis of the 7% credit interest rate that saw the distribution of $457.6M to 405,621 members.

The Fund has paid $2.3 Billion in interest to its members in the last 7 years and $3.1 Billion in the last 10 years.

A testament of the Fund’s dedication to financial excellence, is the impressive streak of consistent total returns over the past 10 years. With an average Return on Investments of 7% in the last 10 years the Fund’s robust investment strategies have not only weathered diverse market conditions but also delivered commendable results, underscoring its resilience and effectiveness. This exceptional performance underscores the Fund’s commitment to delivering strong returns to our members.

COVID 19- its impact and how FNPF managed

When the global health pandemic crippled many economies in 2020 -2022, we stayed focused at the Fund. Our main goal was to handle our members’ funds well and find good opportunities. With lots of people losing their jobs, we kept our relief program going strong. The government pitched in a lot to support our efforts. Despite the challenges, our teams worked really hard to change how we do things to keep everyone safe while still helping our members.

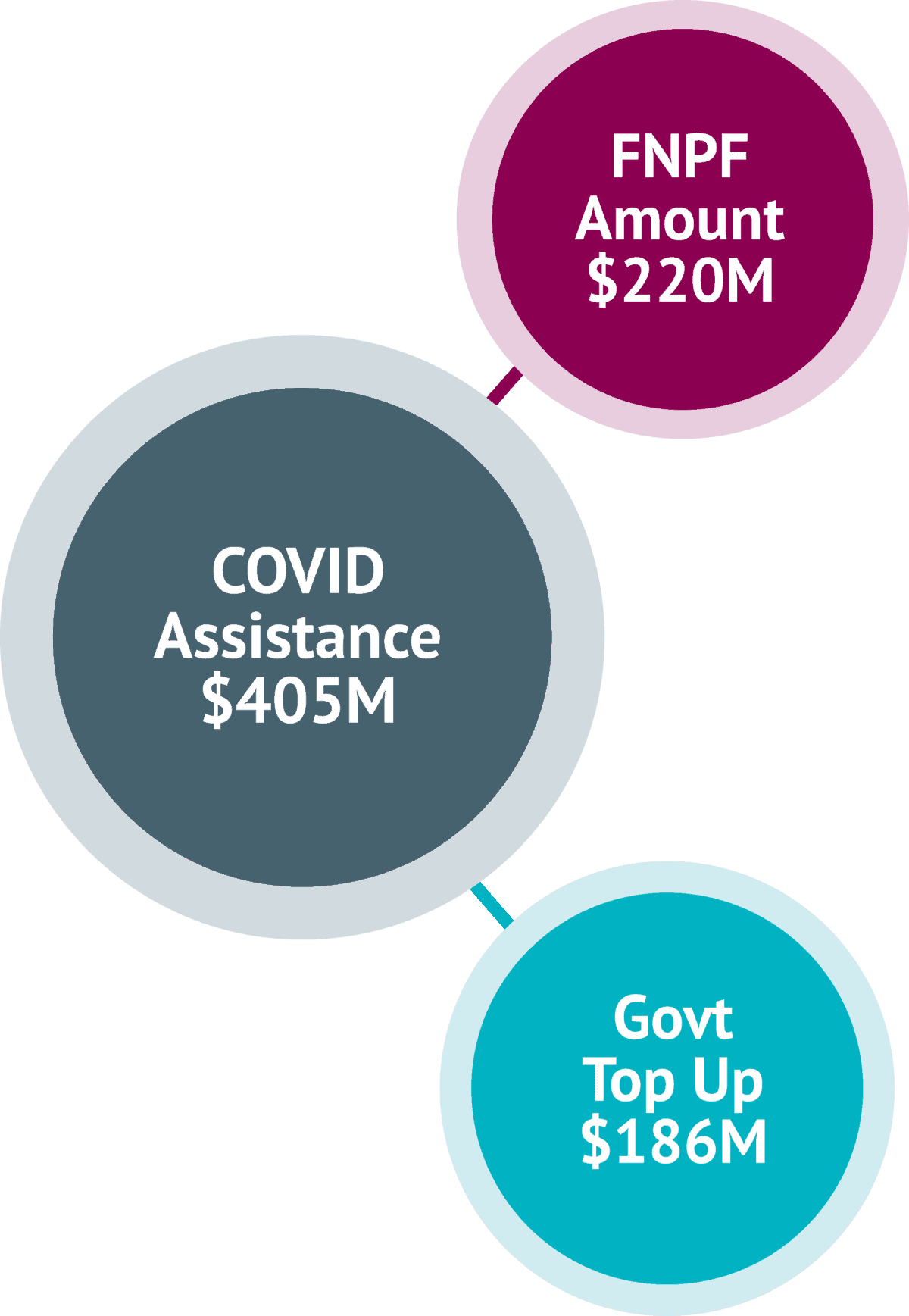

We never gave up on our promise to help our members. We ran 24 rounds of help since April 2020, giving support to almost 140,000 people and giving out over $405 million (FNPF members funds ~$220M and Government top up $186M). We also helped out employers by waiving penalties for over a thousand of them, totalling $6.2 million.

To keep up with the changes, we made our digital platforms better, like improving the myFNPF App, so it’s safer for people to use. We also added live chat and short code numbers to handle all the questions people had.

Despite the challenging times, the determination of our members, pensioners, employers, and our team members was a ray of hope. As we keep going through these tough times, we promise to stick by our members and support them. Interest credited to members in FY21 of $302.8m at 5% and $293.9m in FY20

at 5%. Such returns paid even during the pandemic is substantiated by the Fund’s robust balance sheet position of holding reserves and a history of strong financial performance over the last 10 years.

Why all Returns are not distributed – Reserves Matter

The FNPF provides a capital guarantee to members (meaning members’ funds will be safe). It, therefore, needs an adequate level of capital (reserves) to ensure that it can honour this guarantee. How do we do this? The amount of capital required to be held(reserved) increases [decreases] as the risk in the balance sheet (that is, the assets liability mismatch) increases [decreases]. The capital is reserved from the accumulated net surplus retained after distributing interest to members.

At no point in time can the FNPF Board declare a negative interest rate. Since a negative crediting rate cannot be determined and since interest credited to member accounts cannot subsequently be reduced or reversed, the Board must ensure that its interest rate determination does not threaten the solvency of the FNPF.

Reserves are important for FNPF. Its serves as a vital tool for risk management, providing a cushion against unforeseen events or market fluctuations. Reserves facilitate smoothed returns, enabling funds to mitigate volatility in investment returns and deliver more predictable outcomes to members, particularly during turbulent market conditions such as the COVID-19 pandemic.

It also contributes to meeting solvency requirements imposed by our regulator- RBF. Reserves support the long-term sustainability of the Fund by allowing it to plan for future contingencies and adapt to changing economic and demographic landscapes.

Reserves offer investment flexibility, allowing FNPF to capitalise on opportunities and improve our investment portfolios without relying solely on member contributions or liquidating existing assets. This is done to ensure higher returns for our members.

Also worth noting is the fact that most super funds pass on losses to their members’ but FNPF does not.

Stay tuned for further updates on our remarkable success journey!