SPBD Microfinance, the leading microfinance network dedicated to empowering women microentrepreneurs across the South Pacific celebrated a major milestone in June, distributing US$250 million in loans in its quest to transform lives.

The achievement was marked with the disbursement of a FJ$7,000 loan to businesswoman Miriama Degei (see story on p39). Marking the occasion, Founder and President, Greg Casagrande, said: “This achievement is a testament to the resilience and determination of the women microentrepreneurs we serve.

“Our members are of modest means but have larger ambitions, and we are incredibly proud of the impact we have made in their lives and communities.”

Casagrande continued: “The US$250 million milestone represents not just a figure but the dreams, aspirations, and potential unleashed through microfinance.”

In Fiji alone, SPBD has provided 68,000 loans worth FJ$90 million. SPBD Fiji General Manager, Elrico Munoz, stated: “We are thrilled to have reached this incredible milestone. By providing accessible and inclusive financial services, we have enabled microentrepreneurs to uplift their families and contribute to the overall socio-economic development of the countries where we operate.

“The more than 310,000 loans we have disbursed across five countries, worth US$250 million, demonstrate the transformative power of microfinance.”

SPBD also operates in Samoa, Solomon Islands, Tonga and Vanuatu. SPBD’s comprehensive range of financial products, business skills, financial education training, ongoing guidance, and member motivation what contributed to this significant milestone.

SPBD Chief Operating Officer, Polly Kelekis, adds: “With this milestone, we reaffirm our commitment to fostering economic empowerment and inclusivity in the South Pacific region.”

She says SPBD remains dedicated to expanding its reach, scaling its operation, and driving sustainable changes amongst its current and future members.

SPBD has been instrumental in supporting more than 115,000 Pacific Island women microentrepreneurs, providing them with vital financial resources and enabling them to build their businesses, improve their housing conditions, and invest in their children’s education.

It supports businesswomen that earn FJ$50,000, unlike most institutions and banks that only cater to businesses with a turnover above that amount.

“That’s our working space; our highest earner at the moment is FJ$30,000, but at the same time, we are filling a grey area, where other banks fear to tread,” Munoz said.

“I would make a challenge to banks because if you see our portfolio, it is a very high-rate portfolio, which means our repayment rate is 99% and the risk is less than 1%, which means the risk of investing in microloans is actually very low if you do it well,” he added.

As Miriama Degei received her loan, Munoz advised other women to follow in her path: “Look at Miriama as your role model and inspiration; you can start small but think big, and when we say big, we don’t mean the same business make it grow big, but from that small business create other small businesses, and then you will be more successful in your endeavours.”

Meet the Member

Miriama Degei of SPBD Fiji’s Nakavu Centre is a versatile businesswoman who works tirelessly for her family.

The 52-year-old who hails from Bemana, Nadroga – runs several income streams from the comfort of her home in Votualevu, Nadi – thanks to the support provided by SPBD (South Pacific Business Development).

She specialises in tailoring, weaving, tie and dye, and screen printing. In April 2020, she joined SPBD after her businesses came to an abrupt halt due to the crippling COVID-19 pandemic.

Degei says she had to overcome many obstacles to get to where she is.

“On the 3rd of September 2014, our house was burned down. We lost everything except the clothes on our backs. We lost about FJ$40,000 worth of our belongings, including all my business items.

“I thought to myself, ‘I don’t want to do business again because what is the point of running a business when disasters happen unexpectedly?’ We lost everything, and I thought I could not make it again.”

With the help of the programme, Degei was given a much-needed boost to restart her entrepreneurial journey.

“I began with a help loan of FJ$1,500 and from there, my business started rolling,” she said.

Degei’s entrepreneurial endeavours have expanded further in wooden furniture and coffin making, homemade dishwashing paste, fish selling, pre-packed foods, and even being a private driving instructor.

With her vast skill set, multitasking comes naturally to Degei.

“I was not professionally taught. I have never done any courses, but I just see things how they are made and I learn to do them myself.”

She adds: “When my family goes to sleep at night, that’s the time I do my sewing and screen printing as I don’t want to be distracted.”

The dedicated entrepreneur says her customer base includes family, friends, church members, even gas station workers and supermarket staff nearby.

“The service and products I offer are very demanding, especially during November and December when there are a lot of festivities.

“One of my church pastors is travelling soon to America and has made a big order for dresses and sulus, so I’m getting that done.”

Degei says she remains grateful despite the difficulties.

“SPBD has really helped me in so many ways, especially in times of need. My mum recently passed away and I used my savings to cover funeral costs. I’m very grateful for SPBD because they give me time to do repayments.”

Through SPBD’s help, Degei has gone through three loan cycles. She is now on her 4th, with a new loan of FJ$7,000 to further improve her businesses. This new loan enabled SPBD to reach its US$250 million loan disbursement milestone.

“I’m looking forward to renting a better house so that I can work properly on my business products there.

“I want to buy a second-hand engine for my aluminum boat that needs repairing.

“I also bought on hire some white goods like pressure cooker, urn and an oven from Courts Fiji Limited.”

To aspiring businesswomen, she says: “Don’t ever look down on yourself. Even if you are a woman, you can do anything to achieve your goal. Do your best, whether it’s the smallest thing or the biggest thing. Be committed and believe in yourself.”

SPBD promotes women empowerment and leadership

SPBD’s commitment to women’s empowerment is not only targeted to its members. In fact, SPBD promotes women to senior executive roles across the network. Today, women hold 50% of the top senior executive positions, and three out of five (60%) of SPBD’s General Managers are women. “This gender balance ensures that the experiences and perspectives of women inform decision-making at the highest levels of the organisation. This is crucial because, after all, a key element of our business is empowering women,” noted SPBD Network Chief Operating Officer, Polly Kelekis. “Furthermore, women leaders serve as role models, inspiring other women within the organisation and the wider community to pursue leadership roles.”

The SPBD network qualifies as “2X Aligned,” (https://www.2xchallenge.org/). The “2X Challenge” was launched at the G7 Summit 2018 as a bold commitment to inspire development finance institutions (DFIs) and the broader private sector to invest in the world’s women. SPBD meets three out of the five 2X criteria with 50% women in senior management, 62% women in the workforce, and 97% women customers.

SPBD news from across the South Pacific

The SPBD network has been engaged with numerous initiatives in 2023. SPBD Samoa recently hosted its 19th Annual Business Woman of the Year Awards in Apia on June 9 to recognise and celebrate the wonderful achievements of our amazing SPBD women microentrepreneurs throughout Samoa. Minister of Finance, Honourable Mulipola Anarosa Ale Molioo was the guest speaker at the event. SPBD also hosted its Client Exhibition Market Day in June, and members from across Samoa were able to set up stalls to showcase and sell their goods, which included prepared food, produce, potted plants, clothing, handicrafts and so much more.

On June 7, the SPBD Samoa team also launched a new remittance product in partnership with KlickEx Pacific – a trusted money transfer operator offering a safe and transparent digital payment ecosystem that allows users in New Zealand and Australia to send and receive money into Samoa. The new money transfer service will commence on July 1, 2023, and will provide an online portal for money transfers from abroad – spbd.klickexpacific.com. Enabling Money Transfers now from New Zealand and Australia will further help SPBD members, as well as the Samoan public who choose to use the SPBD Money Transfer service.

SPBD Tonga also hosted its Annual Business Woman of the Year Awards event in Nuku’alofa on June 2. SPBD Founder and President, Greg Casagrande, shared words of encouragement to members. He urged women to keep their dreams alive and pursue them every day; this includes having their children obtain a complete education, including a tertiary education, as part of that dream. The second was the importance of saving and investing. “Make a habit of saving each week, and then invest in your businesses, in your children’s education and in the healthiness of your home. These investments will yield long-term benefits.” And third, he inspired them to seek to lead. “Lead your business. Lead your children. For great leadership training opportunities, look at taking up roles within your SPBD Group and your SPBD Centre.”

The chief guest of the event was The Honourable Dulcie Elaine Tei, Tongatapu 6 Constituency People’s Representative and a female member of Parliament. She acknowledged the hard work and commitment of SPBD members and recognised their contributions to the overall development and progress of the nation.

SPBD Tonga enlisted a new partner to offer its White Goods loan product on Vava’u. The new partnership with Vava’u Shopping Center #2 enables SPBD to reach out to the villages across Vava’u so that high-quality, affordable white goods and major appliances will be accessible to these communities to uplift FineTu’ipulotu, SPBD Tonga GM with BWOY awards finalists their living standards and increase their productivity.

SPBD Solomon Islands was the second SPBD program to launch the Overseas Workers Loan (OWL) product to provide seasonal workers access to credit to assist them with the costs involved in participating in the Recognised Seasonal Employer (RSE) scheme with New Zealand and Australia. General Manager Raymond McCarthy said that the launching of the OWL product is a major accomplishment for SPBD Solomon Islands and a true testament to SPBD’s commitment in providing accessible financial services to the underserved segments of Solomon Islanders. On June 30, SPBD Solomon Islands also launched its White Goods Financing product in partnership with Discount Electrical and Home Leisure (DEHL) to allow SPBD clients to obtain access to high-quality items, such as appliances, to increase SPBD clients’ productivity in their homes and businesses.

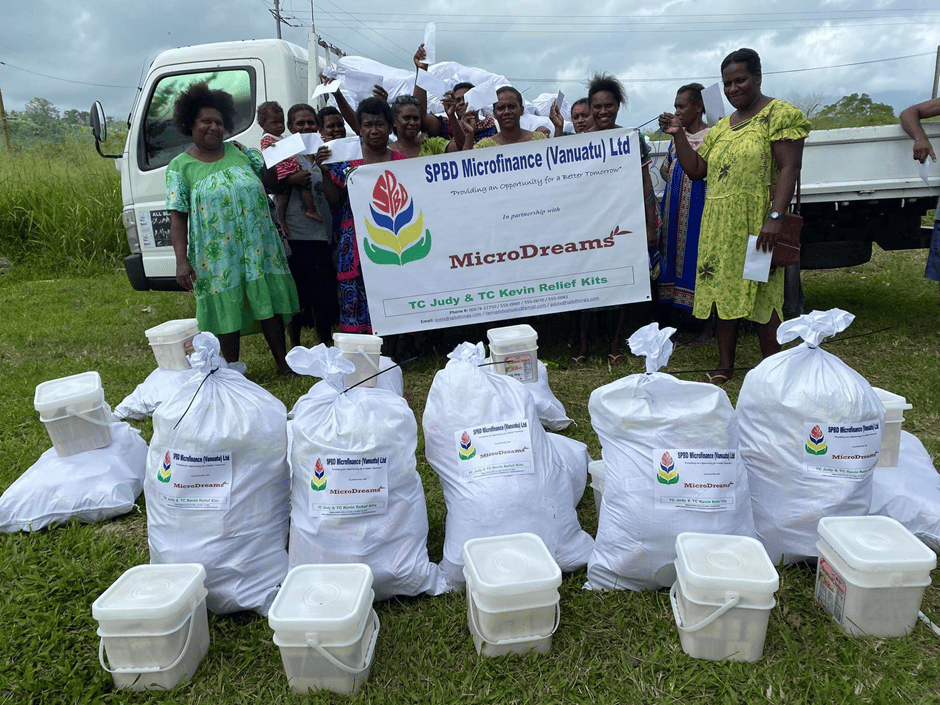

With generous support from the MicroDreams Foundation New Zealand Humanitarian Trust, the team at SPBD Vanuatu successfully carried out an extensive relief programme after Category 4 twin cyclones, Judy and Kevin, devastated the country in March. The team procured, packaged and delivered more than 2,270 relief kits, which included food items and a cash component to families whose housing and businesses were either damaged or destroyed. Team SPBD Vanuatu is also focusing on providing recovery financing so members can rebuild their business and housing. Later this year, the team plans to expand its footprint on the island of Santo.