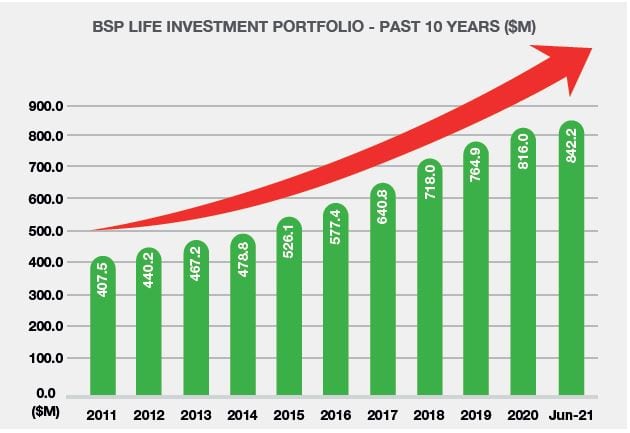

BSP Life recently declared its highest ever bonus allocation in its 145-year history. $32million has been distributed to eligible customer’s policies for the 2020 financial year, which is backed by a strong and diversified $842million investment portfolio. Despite the impacts of COVID-19, customers enjoy a sustained Bonus rate (increase in 2019 from 2% to 2.5% of the policy sum insured) which has been maintained in 2020. This is attributed to the resilience of the Company built up over many years, and the loyalty and confidence of its valued customers.

HOW BONUSES WORK

The declared Bonus rate is applied to the sum insured and the accumulated Bonuses of the policy to obtain the Bonus for the period. Due to this compounding calculation, Bonuses work to add more value to policies.

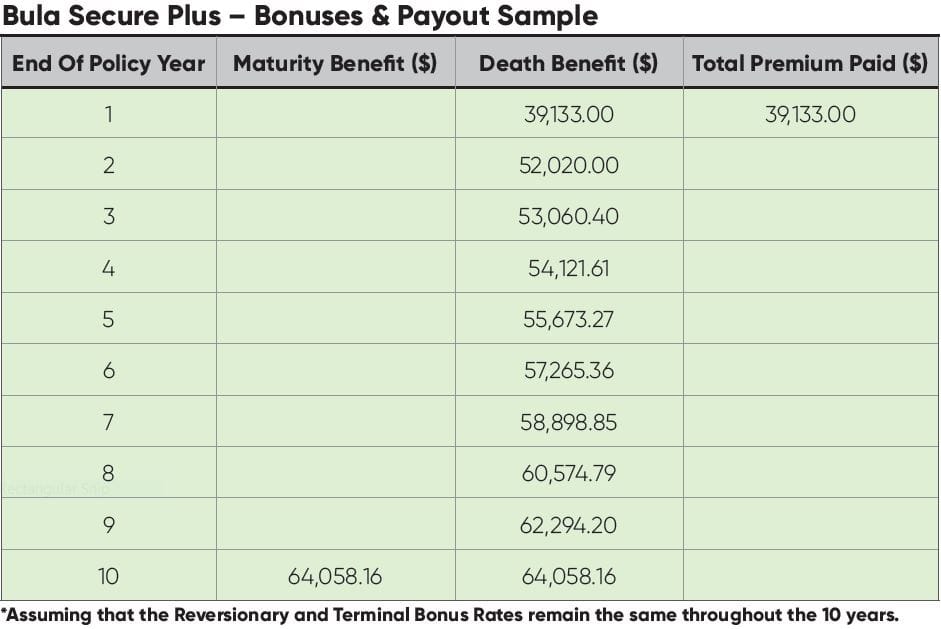

The Bula Secure Plus is one of BSP Life’s latest and popular single premium products.

Key Benefits:

• 10 year term

• Tax free returns

• Free interim accident cover

• Hassle free applications up to $1m sum insured

• Bereavement support included

The sample in the table below shows:

• 41 year old female

• Sum insured $50,000

• Customer invests $39,133

• Total returns: $64,058

• Profit: $24,925

• Average rate of return: 6.37%.

The Bula Delite is one of BSP Life’s most innovative products, that is proving popular with young job starters.

Key Benefits:

• Cash returns every 3 years – 10% of the sum insured.

• Four terms to choose from 15, 18, 21, 24 years.

• Tax free returns

• Ability to include a spouse on the same cover with a Term Life cover.

• Free interim accident cover

• Terminal Illness & Bereavement Support Benefits included

The sample in the table below shows:

• 25 year old male

• Sum insured $25,000

• Customer weekly premium: $25.55

• Total premiums: $31,886

• Total returns: $52,625

• Profit: $20,739

• Average rate of return: 2.71%

FREQUENTLY ASKED QUESTIONS:

What are BSP Life Insurance Bonuses?

Bonuses are returns which BSP Life Policyholders receive by purchasing an investment linked life insurance policy. The returns from BSP Life’s strong and diversified $842million Investment Portfolio is shared to Policyholders through Bonuses each year a Bonus is declared. Once Bonuses are declared, they are guaranteed. Bonuses accrue on policies, until the policies are paid out.

When are Bonuses paid out?

Policyholders receive their Bonuses when policies reach maturity, or Beneficiaries receive Bonuses when Death Benefits are paid out.

How many Bonuses are there?

We have two types of Bonuses: Reversionary and Terminal Bonus.

Reversionary Bonus – Policyholders receive these Bonuses each year that BSP Life declares a Bonus.

Terminal Bonus – is a loyalty reward for Policyholders. It is calculated and added to the Policy value at the time the Policy is paid out.

How are Bonuses Calculated?

When we declare a Bonus, we confirm a Bonus Rate. This Bonus Rate is then applied to the Sum Insured plus accumulated Bonuses to derive the Bonus for the financial year. This compounding calculation ensures that Bonuses add more value to policies.

Does BSP Life sell health insurance?

Health insurance is sold by BSP Health which is a wholly owned subsidiary of BSP Life. For valuable health insurance for you and your family, please visit https://www.bsplife.com.fj/235442-2/