The proposed merger of oil and gas companies Oil Search and Santos could put downward rating pressure on Santos, according to S&P Global Ratings, while other analysts predict more global mergers and acquisitions in the sector.

Australia’s second and third largest oil and gas companies announced in early August they had agreed to merge, subject to due diligence and shareholder vote.

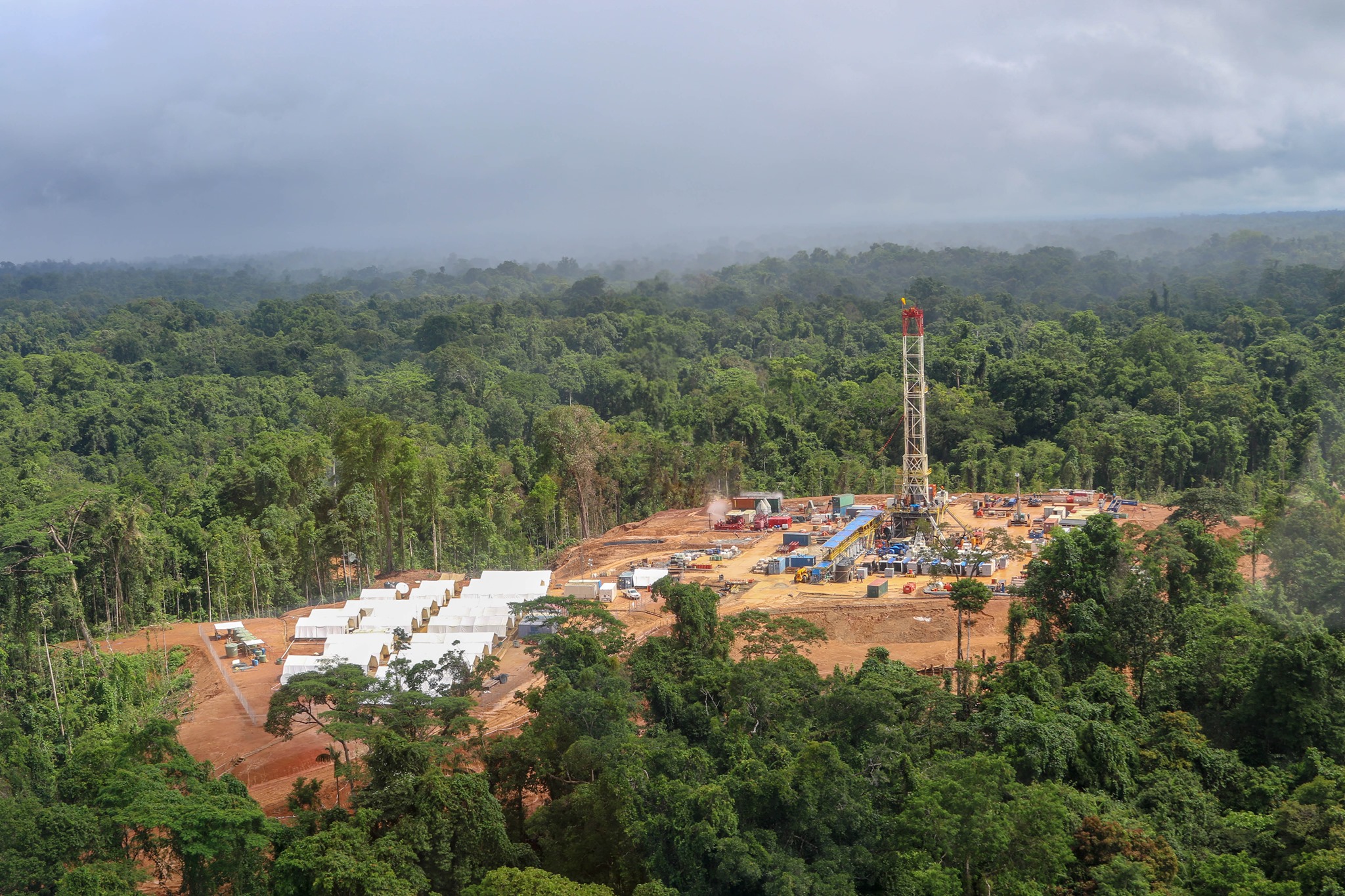

The combined company would be worth $A21 billion creating Australia’s largest independent oil and gas company, with 35% of its production from Papua New Guinea, with other assets in Australia and Alaska.

Oil Search’s production is largely from its 29% stake in PNG LNG, in which Santos also has a 13.5% stake.

Under the deal, Oil Search shareholders would own around 38.5% of the merged group, with Santos shareholders holding around 61.5%,

UBS energy analyst Tom Allen told the AFR the merged entity may consider selling part of its stake in PNG LNG and Oil Search’s Alaska project. He noted at least 40% of the merged company’s gross earnings in 2020 came from PNG, ‘which could attract country concentration risk from ratings agencies.’

S&P has told Islands Business the merger will ‘materially increase’ Santos exposure to PNG, which has ‘a very high country risk’, and could sell some assets.

“That said, we believe the merged group would have the flexibility to actively manage and balance its portfolio. Santos has consistently demonstrated its willingness to recalibrate its portfolio so that individual asset risks are appropriately diversified across its broader portfolio mix.”

Investors and analysts are predicting more mergers and acquisitions in the industry as traditional lenders, as banks prepare to withdraw from the sector over concerns about global warming, pushing the cost of capital higher.

The International Energy Agency says if the world is to achieve the Paris agreement’s goal of limiting global temperature rises to 1.5 degrees, there ‘There is no need for investment in new fossil fuel supply in our net zero pathway’.

Wood Mackenzie Research Director Andrew Harwood says ‘overlapping interests in PNG, a strengthened financial platform and the potential for further portfolio synergies and optimisation provide strong strategic rationale for the merger’.

In a statement, PNG Prime Minister James Marape has said he expects the companies to maintain a significant local presence of senior management in the country.

“We do not wish for the largest oil and gas company operating in our country to simply be a branch office of a foreign company,” Mr Marape said.

“Any proposed merger must satisfy the national interest test,” Marape said.