To make everyday bank transactions easier, Fiji has published its National Payment System Act 2021 and Regulations 2022 in the National Gazette, becoming effective September 30.

This marks a critical milestone in a broader ongoing reform programme led by the Reserve Bank of Fiji (RBF) with technical support by the International Finance Corporation (IFC), a member of the World Bank Group.

IFC says this new legislation and regulations will enable an upgraded national payment and settlement system and central securities depository. In turn, the new infrastructure and systems will facilitate enhanced electronic fund transfers, retail payments and agent banking.

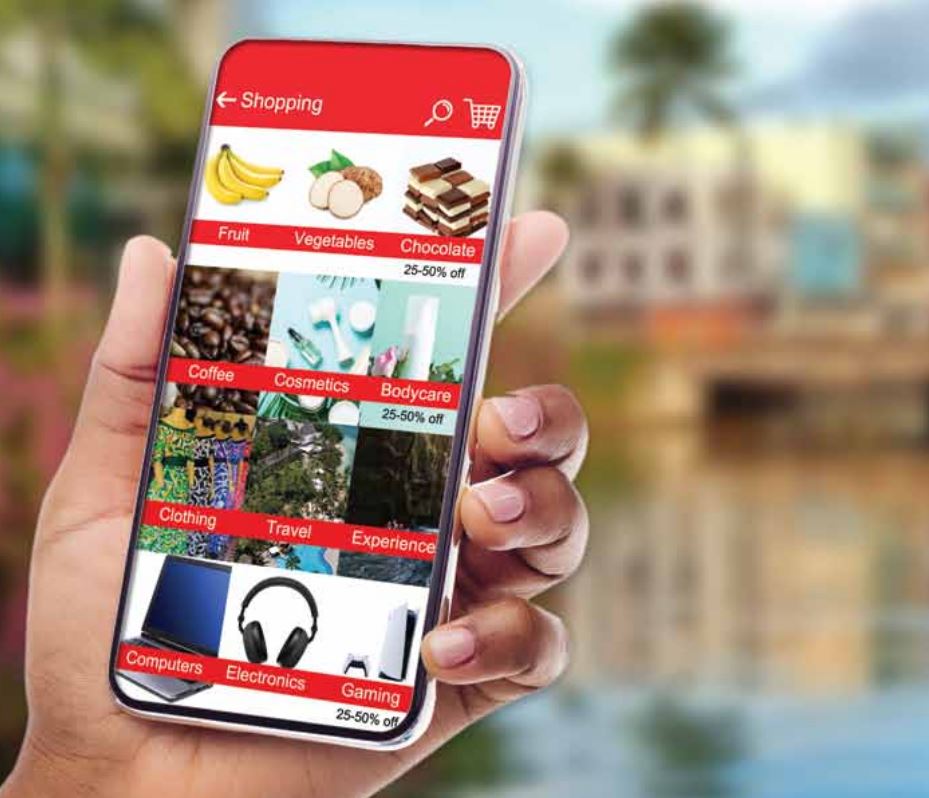

The platform will boost access to affordable payment services through digital solutions, reduce reliance on cash and help drive e-commerce, IFC said.

RBF Governor Ariff Ali confirmed: “the commencement of these regulations will help modernise (Fiji’s) financial system, paving the way for payment systems that support the needs of rural and urban businesses and households.

“Once this reform program is complete, we will have the right infrastructure for innovative payments, with the benefit of increasing access to important financial services for all businesses in Fiji, including micro, small and medium enterprises.”

IFC says the payment system reforms, which are being implemented in phases, will allow financial and payment service providers to develop and introduce additional non-cash payment services and products for their clients in a faster and more secure manner, and at a lower cost.

“These new regulations will help the citizens of Fiji benefit from innovation in payments, offering the potential for digital solutions to help drive financial inclusion, by bringing more people into the banking system, fostering development,” said Judith Green, IFC Country Manager for Australia, New Zealand, Papua New Guinea, and the Pacific Islands.

The changes to Fiji’s payment system regulations come as similar reforms are being undertaken by central banks in Samoa, Solomon Islands and Vanuatu.