Kinetic Growth Fund (KGF) has acquired three key Suva properties from Kelton Investments.

The properties, which were valued at FJ$13.3 million, were acquired in exchange for a mix of cash and equity.

They are Naibati House in Goodenough St, Korobasaqa House in Gorrie St, and Guni House in Gladstone Road. All three properties are fully tenanted, mainly by government departments.

KGF has paid $4.4 million in cash and has issued 7,289.286 shares to six parties who are shareholders in Kelton.

The sale is expected to close within 90 days. The cash portion of the sale is being financed by bank debt.

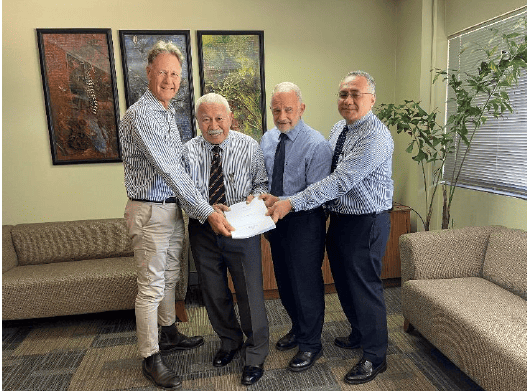

KGF Chairman, Erik Larson, said the transaction would be transformative for KGF and represented an outstanding opportunity for KGF’s shareholders. “The high-quality property portfolio will be cash flow positive, and we expect that KGF will move immediately to profitability. The deal is strongly value accretive and by our calculations, has the potential to increase KGF’s net asset value per share by around 15%. On a pro forma basis, using the March 2023 assessed value of the properties, cash component of the transaction, and share issuance, KGF’s NAV as at 31 October would be $1.05 compared to the $0.90 announced.”

Anthony Ah Koy, Managing Director of Kelton said the companies have collaborated for many years, and this is but the latest chapter in their relationship.

“While KGF is currently a relatively small investment fund, we believe it has the potential to grow into a major player in the investment industry in Fiji. Our entry is not only a way to catalyse this growth, but a confirmation of our confidence in KGF’s potential. Our confidence is underlined by the fact that Kelton and its associates will be taking a significant portion of the transaction value in KGF shares”.

He has flagged the potential for further cooperation in Kelton pipeline projects.