The 2023/2024 Budget, which is themed ‘Rebuilding our future together’, is focused on reducing debt to sustainable levels, promoting private sector economic rejuvenation and taking care of the low income and vulnerable households says the government.

The deficit for FY2023-2024 is budgeted at $639.1 million, or -4.8% of GDP, almost half the average deficit of the past four years. The government says this will see the debt-to-GDP ratio fall to 79.3%- down from 81.2% (July 2023).

Government revenue

The Fiji Budget projects government revenue of $3,700.7 million in FY2023-2024. Tax revenue projections make up $3,107.7 million, an increase of 38%. Non-tax revenue will be $593.1 million from cash grants, dividends from State Owned Enterprises and profits from the Reserve Bank of Fiji.

Tax reform

The government is seeking to:

- Widen the tax base by removing exemptions and other distortions

- Improve tax compliance and collection of arrears

- Review non-tax measures on a cost-recovery basis

The tax regime will be simplified. No new taxes have been introduced, but some existing ones have been restructured.

There has been no change to the tax-free threshold on personal income tax.

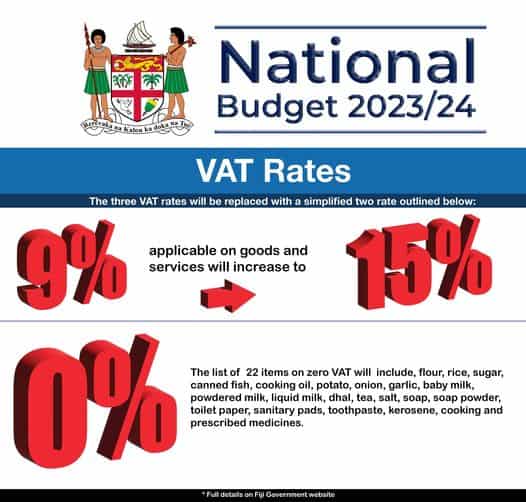

Value Added Tax (VAT)

There will be no VAT levied on 22 items—the 21 that are already VAT-exempt plus a new category, listed prescribed medicines. For all other items, VAT will be 15%. The former 9% VAT rate has been eliminated. The government says these measures will generate additional net VAT collections of about $446 million.

VAT monitoring: Stage 3 of the VMS roll-out has been paused and the entire system will be reviewed. Fiji Revenue and Customs Service CEO, Mark Dixon told Islands Business this review will be with an eye to using the VMS as a compliance mechanism, rather than something that is to be applied to businesses of every size.

Corporate tax

Corporate tax will increase by 5% to 25% effective from 1 August 2023. Companies newly listing on the South Pacific Stock Exchange—who pay a concessional rate as part of incentives related to listing— will also see their tax rate increase to 15% for a seven-year period.

These corporate tax rate increases will add about $73.5 million in revenue

The Social Responsibility Tax (SRT) will now be merged with PAYE income tax. It will be reduced by 5% for those earning above $270,000 per annum.

Departure tax

Departure tax increases to $125 from 1 August 2021, up $25. It will increase further, to $140 from 1 January 2024. This will add a total of $30 million towards overall tax revenues.

Increase in excise duties

The duty on alcohol and tobacco products has increased by 5%. Duty on carbonated/sugar-sweetened drinks increase from 35cents/litre to 40cents/litre effective today.

New taxes on juices, ice cream, sweet biscuits, snacks and sugar confectionaries of 15% per kilogram or per litre, will be effective from 1 January 2024.

Motor vehicle import excise duty will increase on all new and used passenger vehicle by 5%, effective today.

Decreases in duties

The duty on canned mackerel, corned mutton, corned beef and beef, prawns and duck will be reduced from 32% to 15%. Duty on sheep/lamb meat will be eliminated. Fiscal duty on canned tomatoes will be reduced from 15% to 5%.

Import excise on chicken portions will be eliminated.

Restructuring tax incentives

The former Information and Communication Technology (ICT) incentive will be restructured to cater for:

- Business process outsourcing (BPO)

- Knowledge process outsourcing

- Information technology outsourcing

- Shared services/global business services.

Companies wanting to access these incentives will need to register with the BPO Council of Fiji and meet minimum capital investment and employee requirements. At the minimum level, this is a $100,000 investment and 25 employees.

Fuel tax rebate

A 10 cents/litre fuel rebate will be provided to bus operators in Vanua Levu and Taveuni. The 2 cents/litre rebate continues in all other areas.

Water resource tax

The water resources tax increases from 18 cents/litre to 19.5 cents/litre for every litre extracted exceeding over 10,000,000 litres per month, and is expected to generate net revenue of $2 million.

Customs concessions

Certain concessions will be removed on imports of raw materials, packaging materials, biodegradable products, LED lamps and lighting and smart phones.

Duty concessions for fuel, broadcasting and internet service provision, and for materials for the fit out of hotels and resorts will cease.

Removing these customs concessions will collect some $35 million in revenue.