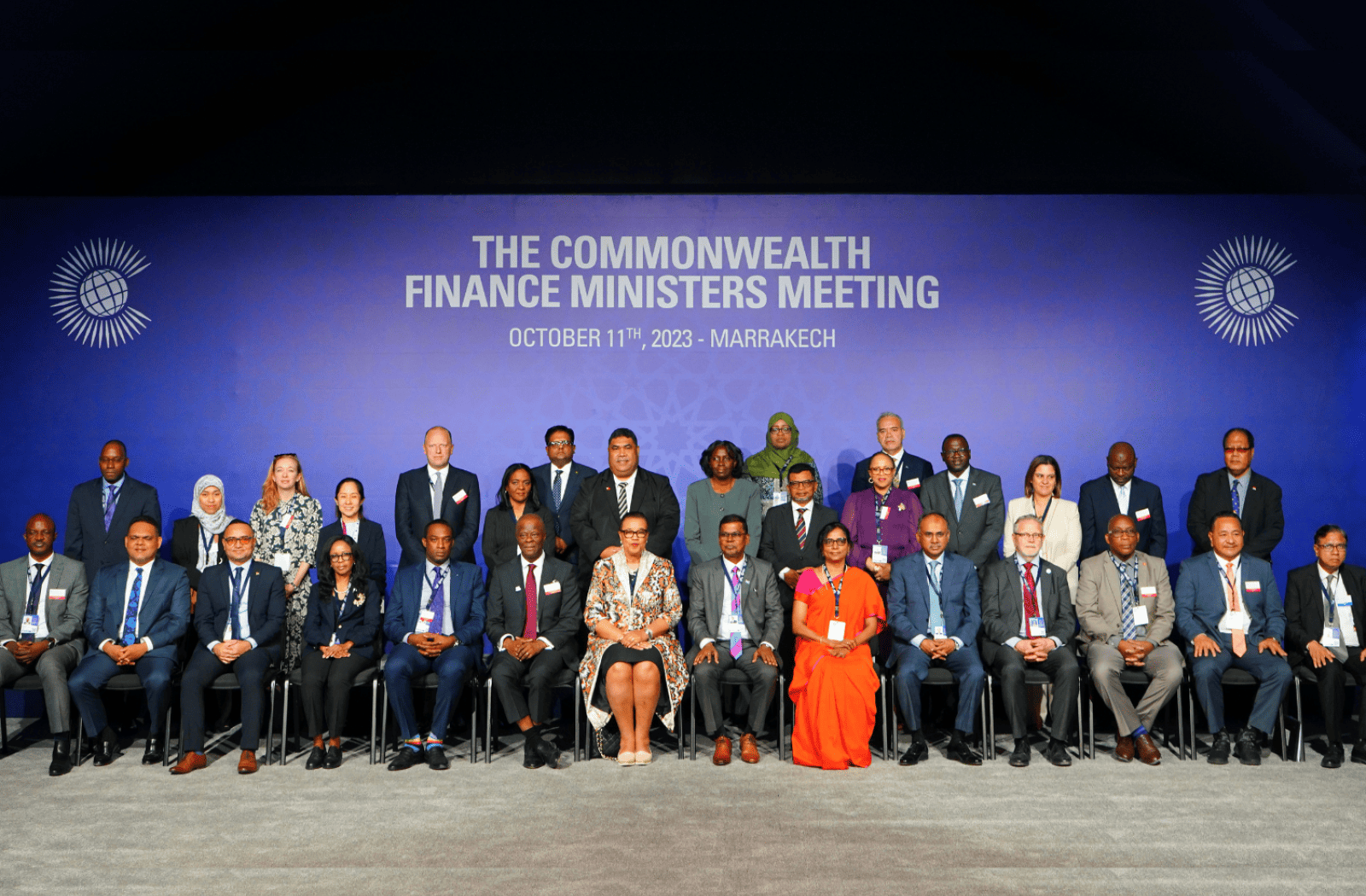

Commonwealth Finance Ministers met this week in Marrakesh, Morocco to discuss the reform of the global financial architecture, with particular attention to two pivotal areas, scaling up development finance and addressing debt vulnerabilities.

Meeting on the sidelines of the World Bank and International Monetary Fund (IMF) annual meetings, the session was chaired by Professor Biman Chand Prasad, Deputy Prime Minister and Minister for Finance, Strategic Planning, National Development, and Statistics of Fiji.

The Commonwealth Finance Ministers Meeting (CFMM) is a vital platform for open and frank dialogue between Commonwealth members on global and domestic economic issues. During the meeting, ministers seized the opportunity to exchange best-practice strategies for ensuring debt sustainability. It also provided a forum for Commonwealth developing countries to engage with G7 and G20 members, fostering collaboration and the development of shared positions on pressing global economic challenges.

In her opening remarks, Commonwealth Secretary-General Patricia Scotland emphasised the significance of the discussions.

“The storms we face are real and serious. To achieve greater sustainability and greater resilience for Commonwealth economies we need to summon all our unity and all our strength to push for global reform. We need to enhance access to finance while increasing our ability to make every penny count. We meet at a critical time and the case for reform of the global financial architecture is clear and urgent.”

Professor Biman Chand Prasad, in his opening remarks, underscored the necessity of global financial reform.

He commended the Bridgetown Initiative, developed by Commonwealth member Barbados, which calls for urgent and decisive action to address overlapping crises and reform international financial institutions.

Professor Prasad went on to stress the importance of collective efforts in tackling global challenges and reaffirmed Fiji’s commitment to multilateralism and addressing climate change.

Ministers received a presentation from the Commonwealth Secretariat that highlighted strategies for building economic resilience, such as:

*The role of blended finance in mobilising private investment and addressing market failures to support climate action.

*Debt-for-nature swaps as financial instruments to provide fiscal space and promote climate-resilient projects.

*The introduction of new climate-related levies to mobilise domestic revenue for financing development needs.

*Blue and green bonds and domestic revenue mobilisation and the importance of blue finance to address climate change and biodiversity loss.

*International initiatives such as increasing liquidity through Multilateral Development Banks (MDBs) and implementing the G20 Sustainable Finance Roadmap.

*The need to review Debt Sustainability Analysis (DSA) frameworks, and the inclusion of climate vulnerability in DSA frameworks to reflect the impact of climate-related investments on debt sustainability.

Ministers delved into these critical topics and concluded the meeting by underscoring the importance of taking urgent action to reform the global financial system, enhance development finance, and incorporate climate vulnerability considerations into financial analysis. The CFMM highlighted the Commonwealth’s commitment to addressing global financial challenges and member states’ shared determination to foster sustainable development and resilience.